That means you need to calculate your business’s sales receipts total for the year and write it in Line 1. This line once had multiple subheadings but has been reduced to one simple line. Here, you’ll begin with your gross sales receipts. Your answer on Line I will determine your answer to Line J: if you owe 1099s, make sure you send them. The deadline to send out these 1099s is January 31.

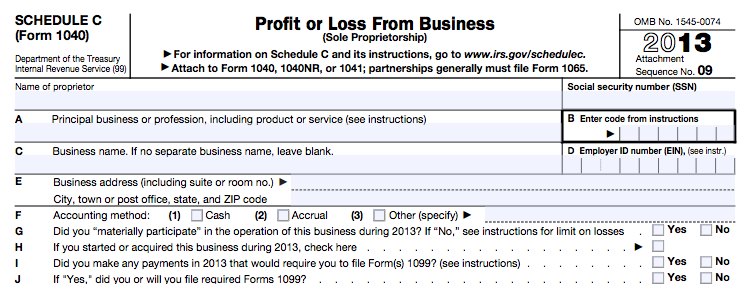

Line I:ĭo you need to send any 1099s? In general, if you paid any contractors more than $600 throughout the year, you must send them a 1099. Is your business new (or new to you) this year? If so, tick this box. If you mark “no,” you should see the instructions for further clarification. The exceptions tend to be if you’re solely an investor, your business is a rental activity (like leasing equipment), or employees or contractors did the majority of the work. Line G:ĭid you materially participate in the operation of this business? Most businesses will mark “yes.” As a sole proprietor or single-member LLC, it would be unusual not to play a substantial role in business operations. The accrual method is used when you count income when services are rendered, orders are place, or some other transaction occurs, but you have not yet received any money.įor further explanation, see Schedule C Instructions. In the cash method, the income isn’t counted until cash or check is received for your services or products. You’ll have to select your accounting method. If you’re not well-versed in IRS linguistics, Lines F through J might be a little tricky. An EIN is a federal tax ID number (if you don’t have an EIN, just leave the space blank.) Lines F Through J

The rest is simple contact information: your business’s name, address and EIN.

#Schedule c tax form code#

For Lines A and B, you’ll describe what your business does and pick a 6-digit code from the instructions that best describes your main business activity. General Business Information Lines A Through E But have no fear.Īll you'll find here is an explanation of what the Schedule C requires in the simplest language possible, so you can be prepared when it’s time to file. If you’ve never filed a Schedule C, you’re bound to feel confused by some of the language you encounter. The form is longer than the EZ, but at only two pages, it’s far from the longest one the IRS has to offer. Your Schedule C should be filed as an attachment to your personal income return. The rest of this article, however, focuses on the more complex Schedule C.

It’s worth taking a moment to look at the list of requirements at the top of the form to see if your business qualifies. Schedule C-EZ is a similar but much simpler form. What is the Schedule C Form?Īt its core, the Schedule C is nothing more than a profits and losses worksheet for sole proprietors and single-member LLCs (as long as the LLC hasn’t elected to be taxed as a corporation).īefore jumping into the details of Schedule C, it’s important to note that if you have $5,000 or less in business expenses, you may be able to file a Schedule C-EZ instead. Before the cold sweat and anxiety of tax season gives you a clammy embrace, make sure you know what you need to complete your Schedule C Tax Return.Ī little preparation and you’ll likely find there’s nothing much to worry about.

If you operate a sole proprietorship or single-member limited liability company (LLC), tax time can be worrisome, especially if you’re doing your own taxes.

0 kommentar(er)

0 kommentar(er)